In this guide, you will learn how to setup the display of the price without Sales tax for products in your e-shop. You can also display that the price of the product excludes shipping costs.

In the United States, sales tax is governed at the state level. As a seller, you have an obligation to collect sales tax from a customer that lives in the same state where your company is located. Hence, you are not required to collect sales tax from a buyer that lives in a different state.

ATTENTION: These instructions are only valid for US e-shops. If you do business elsewhere, please visit the article How to set the display of the price with or without VAT for products.

ATTENTION: The function (apart from the Shipping price option) is only available if you have turned on Sales tax in the e-shop. You can find out how to enable this option in our guide Basic settings - see the Sales tax section. In this manual, you will also find information on how to set the tax rate (see the Sales tax section).

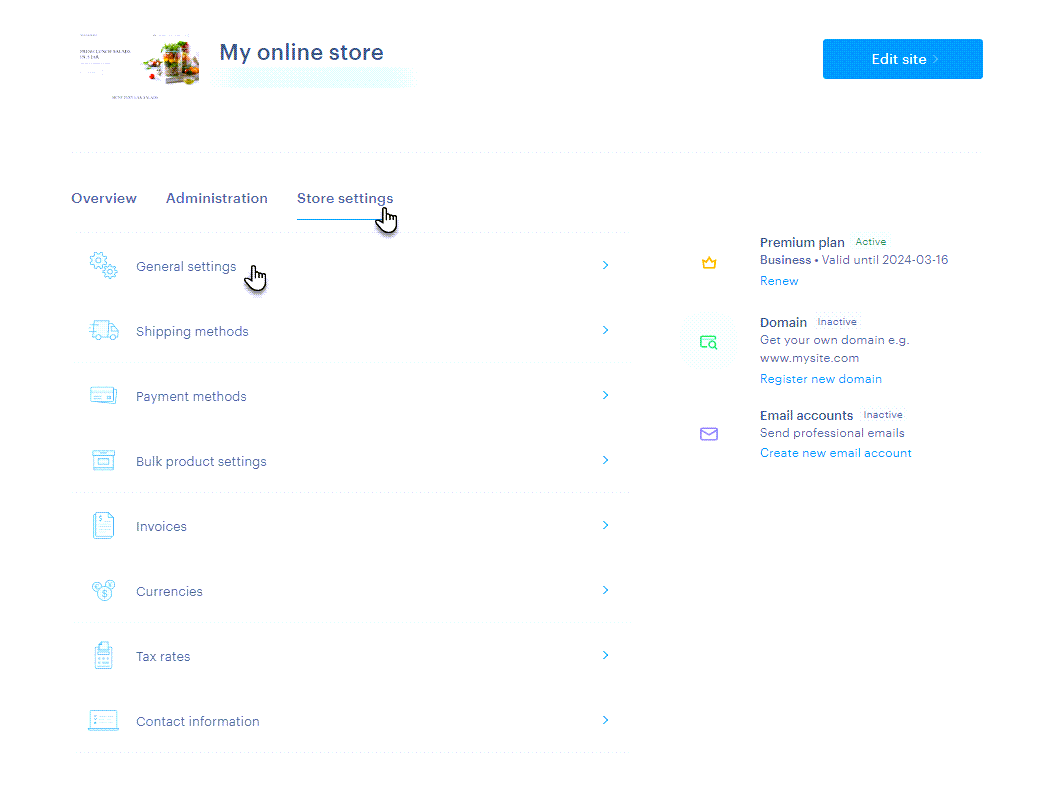

1. In the project administration, click on Store settings, and then on General settings.

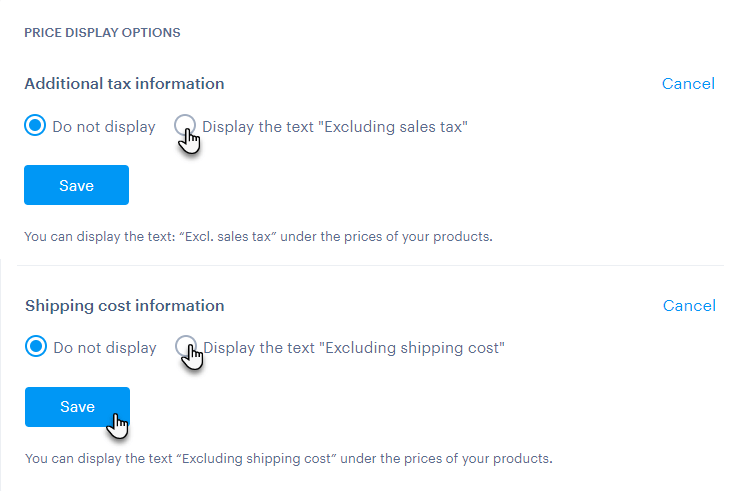

2. Here, in the Price Display Options section, you can edit individual options by clicking the button.

A. Additional tax information: This option will display the message "price excluding sales tax" below the price of your e-shop products.

B. Shipping cost information: Here you can enable the display of the message "excluding shipping cost" for the price of the products.

3. Don't forget to save the individual options with the Save button.

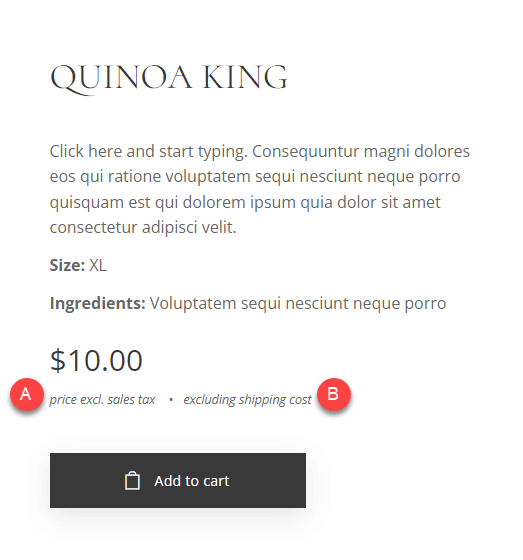

This is how the individual options will be displayed on the product card.

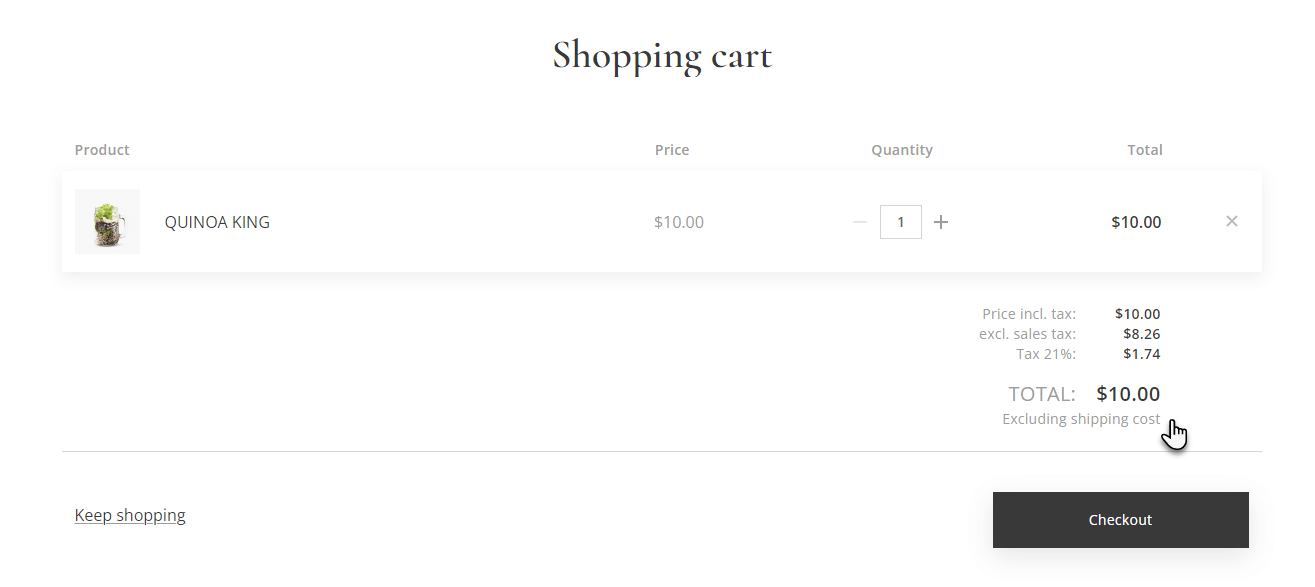

Then on the Cart page.

TIP: If you have multiple tax rates set, you will be able to select the rate for this specific product in the product detail. Click on the current tax rate and select a new rate from the list. For more information on product management, see How to edit a product.